Five-year mortgage rates average 6% for first time since Truss fiasco

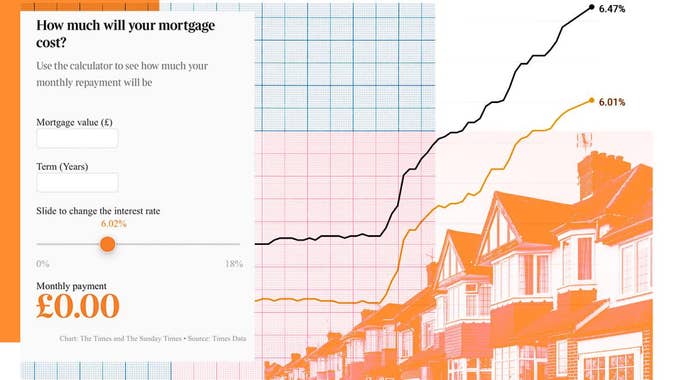

The average five-year, fixed-rate mortgage has topped 6 per cent for the first time since November as banks and building societies continue to push up rates.

Five-year fixes have risen from 4.97 per cent to 6.01 per cent between the start of May and today, according to the financial data analyst Moneyfacts, adding £1,488 a year to repayments on a typical 25-year mortgage worth £200,000.

It is the first time the average rate has reached 6 per cent since November 21, in the aftermath of the Liz Truss mini-budget that sent borrowing costs soaring. Before that, rates had not been so high since December 2008, in the heat of the financial crisis.

Rates have shot up over the past two months on the back of consumer price inflation that eclipsed expectations. The rate has remained stuck at 8.7 per cent in successive months, the Office for National Statistics said.

This has fuelled expectation that the the Bank of England will again increase the base rate, presently 5 per cent, and keep it higher for longer.

The base rate has risen 13 times since an all-time low of 0.1 per cent in December 2021. These expectations of future Bank of England rates, called swap rates, are used by banks to price fixed-rate mortgages.

Five-year mortgage rates are below two-year rates, which now average 6.47 per cent, because of the expectation that rates will fall away in time. Two-year fixed rates peaked at 6.65 per cent on October 20.

When will interest rates fall?

Last week the Bank governor, Andrew Bailey, said rates were likely to stay higher for longer because of “more persistent” inflation. Hope of a fall remains because so many of the big banks have pushed their mortgage rates up so much.

Nick Mendes, of the mortgage broker John Charcol, said: “The majority of the big high street lenders have already made substantial increases to their rates which means they currently sit outside of the best buys.

“Fingers crossed that rates might stop rising soon if swap rates calm down, although I still think we may see further increases in the future if there isn’t substantial progress in bringing down inflation.”

Banks including HSBC and Santander have been forced to increase mortgage rates or even turn away new customers at short notice over the past few weeks because they have found themselves at the top of the best buy tables and inundated with demand.

David Hollingworth, from the broker L&C Mortgages, said: “Maybe the increases will not be as significant . . . Things haven’t levelled out yet. We should hope to find a bit of a level in the coming weeks, but it might be weeks. We just need some good news.”

Even though five-year deals are cheaper than two-year ones, fewer homeowners are taking them. Riz Malik, director of the broker R3 Mortgages, said: “Most of our clients are now choosing two-year fixes, because a significant number believe current rates cannot be maintained indefinitely and that, eventually, interest rates will come down.” The portion of new mortgages taken out on a five-year fix fell below 50 per cent in April for the first time since rates began rising in 2021, according to the trade association UK Finance.

Add comment